So many of us are conflicted about money. Do we deserve it? Hate it? Like it? Reject it? Lust after it?

I’ve spent so many years talking and writing about money, not because I love spreadsheets and investing, but because money – our relationship with money – is such a wonderful mirror. In our attitudes, beliefs, habits, and daily practices we see in great detail both our neurotic and our inspired selves. Who are we? What are we here for? What do we actually need to be fulfilled? Which desires are best satisfied by money and which by other currencies?

Yum. It’s all so delicious to consider, and slathering shame and blame all over this mirror only robs us of its clarity.

The phrase “money becomes you” unlocks at least three facets of our relationship with money.

1. Everyone looks good in money – not ostentatious displays, but the unfurrowed brow of someone who has what she needs, and knows it.

Everyone deserves enough money to live a life they love. Everyone looks good in a Goldilocks set of things – not too much, not too little, just right. To the extent that our well-being depends on buying things, money can make us beautiful. We can celebrate it, wear it in a relaxed and elegant way, thank it for all it provides every time we spend, open our minds to ways to bring in more if we feel pinched so we can have more ease, more sufficiency.

2. Our purchases can be like fuel – energizing our lives. It becomes us because it adds to our possessions, persona, and power.

Purchases, though, can also be like empty calories – weighing down our closets, the unattended corners of every room, our storage sheds. This weight, even if it is “out of sight out of mind,” leaks our sense of fitness, of being up to date with ourselves, and being ready to respond to life. Leaving the house you can hear these unattended, unneeded things nagging… fix me, put me away, sharpen me, mend me, sort me, me me me.

3. How we handle money determines, to a large extent, our future.

Who you are next year or in ten years is deeply affected by today’s choices. The consumer culture encourages unconsciousness. Credit cards are like sugar – they get you high at the point of purchase but let you down when the bills come. Everyone should flatten all debt every month – never miss a payment for a credit card (paid in full), a car payment, or a mortgage payment. Any student should be as resourceful as possible on getting scholarships, not loans, and considering what type of education they really need and what institution is perfect for their objectives and their resources. Everyone should save every month and there are calculators that help you see how saving early and often assures you will have a comfortable retirement – maybe years earlier than official retirement age. The economy is no longer a birth-to-death kindly grandpa who makes sure you will never freeze or fail. It’s largely up to us whether we will be bag ladies or free agents later in life.

An unconscious relationship with money, however, is totally unbecoming.

It brings out the worst in us. The consumer culture aids and abets all seven deadly sins: pride, greed, lust, envy, glut

Our money mirror companions us for our entire lives. We are never done learning, because it’s not just about money as a “means of exchange” or “store of value.” It’s about us.

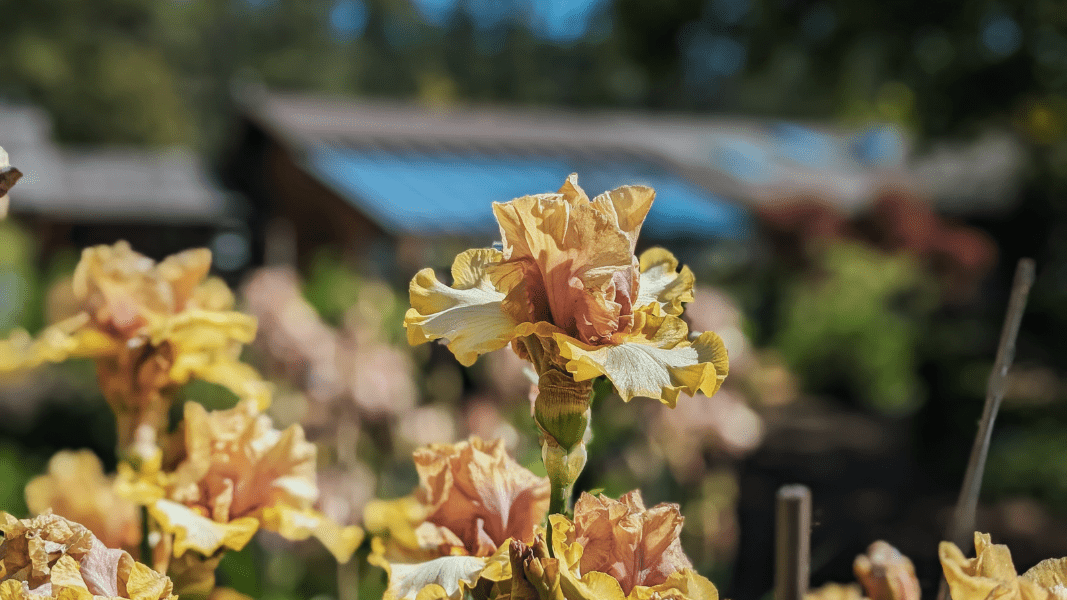

Take a look at your own money mirror with me at Your Money or Your Life at Hollyhock this September. As I focus ever more on the LIFE part of Your Money or Your Life, my actions blossom out into meaning, purpose, service, design, with money as but one note, rather than the entire melody of my work. I think you will agree that this new context is… becoming.